March 2023 Market Update

Wednesday Mar 08th, 2023

THE MARKET MARCHES ON ...

It was about this time last year that we saw the first subtle fissures in the dramatically overheated real estate market occur; in fact, we can pinpoint it to right around Family Day of February 2022. Nothing was the same after that long weekend, with the tiny cracks widening week over week into obvious gaps in activity across the board. The unfettered upward trajectory of the maniacally strong Canadian housing market had finally reached its zenith, ending a 22 month rampage that no one could have predicted at the start of the pandemic. By mid-March, we all knew it to be true. The peak was behind us, and now it was all about the descent.

Today, the economic enormity of the fallout is still ongoing, but a glimmer of hope is on the horizon. The naysayers will argue it, and the debate will rage on between the economists, analysts and great financial minds of our country, but behaviour doesn’t lie. Buyers are buying. Multiple offers are happening. And good inventory is shockingly scarce. The entry level price point is gravely underserved right now and it reminds us all of the one truth that never goes away: we have a housing shortage in Canada of epic proportions.

And too, there’s a bit of a reprieve in the mortgage arena. From all indications, the Bank of Canada seems satisfied with the recent spate of rate hikes, enough to forestall any more increases for now.

As has happened before, the buying activity of Durham Region house hunters is flying in the face of those dour forecasts and predictions that say we haven’t reached the bottom yet. As we trudge further into the year, we will see if seasonal inventory booms correct current conditions or not. More listings could align activity into a balanced market, which would be ideal. Or, we could see the pendulum swing in either of the two directions: further drops in value due to an excess of inventory, or the continuation of the slight uptick in sales prices we are currently witnessing due to a shortfall. It’s still too soon to tell. But as a company, RE/MAX Jazz provides in-depth market analytics every week to all of its agents, and even includes the volume of showing activity on our collective listings – a key metric that goes largely unexamined by most. That information is vital to understanding the market. It informs all of the successful strategies we employ for our clients and it educates our buyers and sellers accurately on the real time condition of our local market. This is just one of the many reasons why RE/MAX Jazz continues to be a leader in the local marketplace, 14 years and counting.

DON'T EXPECT A HOUSING MARKET CRASH, SAY'S RE/MAX ...

As interest rate hikes destabilized Canada’s housing market over the last year, a new report from RE/MAX offers some reassurance to anyone who’s concerned about a housing market crash. Despite the difficulties of the last year, homeowners are well-prepared to weather the storm. As such, a 2008-esque crash just isn’t in the cards for the Canadian market.

According to the real estate firm, loan-to-value ratios declined in 67 percent of Canadian markets over the last decade – meaning homeowners own more of their homes outright than ever before. The lowest loan-to-value ratios were observed in some of the country’s most expensive markets – with Vancouver, Toronto and Hamilton all having averages of over 50 percent. On a national basis, loan-to-value ratios hovered around 57 percent.

“While challenges certainly exist in today’s high interest rate environment, risk factors for the overall housing market are greatly reduced when homeowners own a larger portion of their homes,” Christopher Alexander, president of RE/MAX Canada, said. “With half of loan-to-value ratios within the 50 and 60 percent range in Canadian markets, homeowners are better able to withstand downward pressure on housing values and fewer will find themselves underwater, carrying upside down loans.”

RE/MAX cites three key reasons for the downward pressure on LTV ratios over the last decade: equity gains, the pandemic facilitating the rise of remote work in smaller markets, and the transfer of intergenerational wealth.

Canadian homebuyers are much better qualified as a result. The number of buyers with credit scores below 660 has dropped significantly in the last 10 years and fell to 4.7 per cent in Q3-22. Mortgage delinquency rates also fell in most markets across the country, with the national percentage sitting at 0.14 per cent – down over 63 per cent from 2012. Ontario and British Columbia had the lowest rates of delinquency at 0.08 per cent. Overall risk for the market remains low, thanks in part to the stress test.

According to RE/MAX, population growth drove home buying activity over the last decade. The quarterly population estimate has risen by 12 per cent on average from Q3-2012 to Q3-2022, and population growth isn’t expected to slow down any time soon. Looking towards the rest of 2023, the real estate firm expects smaller markets across the country to grow as consumers turn their attention away from expensive urban markets.

DATES TO REMEMBER:

03.08 - INTERNATIONAL WOMAN'S DAY

03.10-17 - PUBLIC AND SEPARATE SCHOOL MARCH BREAK

03.13 - DAYLIGHT SAVINGS TIME BEGINS

03.17 - ST. PATRICK'S DAY

03.20 - SPRING EQUINOX

03.23 - NATIONAL PUPPY DAY

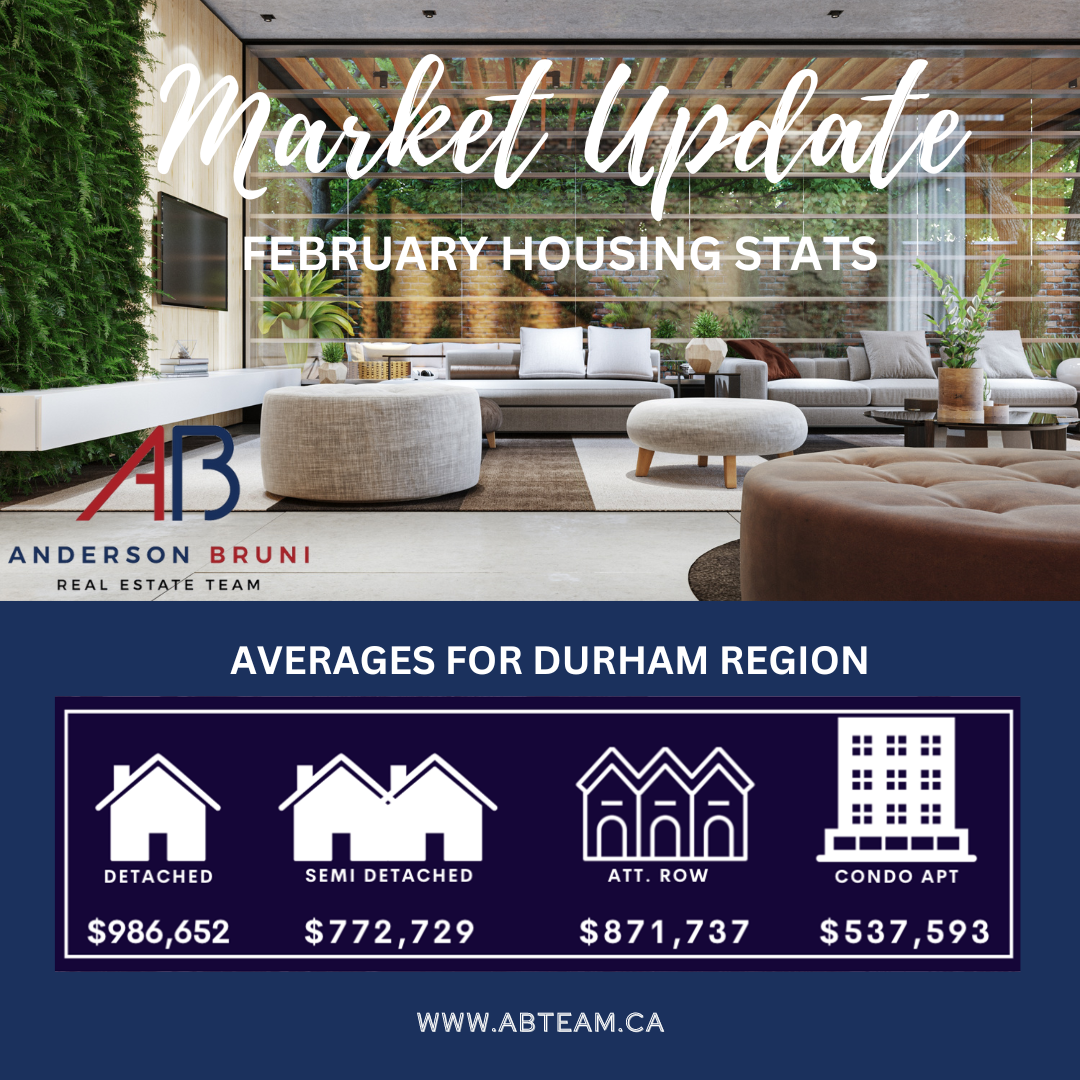

MARKET UPDATE!

We are just a call, text, email or visit away from guiding you and your loved ones through the single most important transaction of your life. Thank you for your trust.

Post a comment