ABTEAM May 2025 Blog Post

Friday May 23rd, 2025

WELCOME TO THE ABTEAM MAY BLOG

MAY: THE MONTH OF HOPE FOR OUR LOCAL REAL ESTATE MARKET

The first quarter of the 2025 housing market here in beautiful Durham Region can easily be summarized in this way: it has been a time of patience and managing expectations. Certainly for sellers and their agent representatives, that has been the lived reality.

A trifecta of surprise events – terribly harsh weather, the unexpected trade war and a snap federal election – have worked together to produce just enough uncertainty to cause buyers to hesitate in their decision making. Is it a full retreat? No, but the market is definitely soft. Even a massive spike in listing inventory over the first three months of the year has not been enough to spur on the sales volume that we should be seeing. Entry level homes continued to dominate sales for the first quarter, but the move up and what we call “aspirational” markets – like luxury homes and cottage properties – are really struggling. We do, however, anticipate an increase in buyer participation as the warm spring weather takes hold and the season lengthens; it will also be incredibly helpful to get the election behind us and the trade war settled into some form of agreement that is fair for Canadians. Oh, and did we mention lowering borrowing rates? Yes, that would help too.

Nothing harms the real estate market like the unknown. People want to sell and buy with confidence, and to achieve that, they need to feel that they have job stability, financial security and are trading under economic conditions that favour growth. That consumer confidence metric is the key to every strong real estate market. Without it, we tend to flat line.

Please bear in mind that there is always lag in our reporting. This may be our May report, but it contains March’s numbers which were only just released. As always with real estate, it’s what is happening in real time that truly counts. The rear view mirror only adds context, not necessarily clarity, for the present. And be careful what you consume from the media as truth; they use blanket statements that cover the gamut of the national market and lump all styles and types of dwellings together (freehold and condo), much of which does not paint an accurate picture at all of what is happening here.

As conditions continue to evolve, we are committed to providing you with the most current information available and proving our worth to you as your real estate advisors for life. As always, we are here to educate and inform you, to ensure you know what forces are at play that can affect the precious asset you call home. If you would like a personal update, or if you know of someone who could benefit from our knowledge and experience, please reach out to us. We are here to serve and welcome the chance to be worthy of your personal recommendation.

THE MONTH OF APRIL IN REVIEW

In April, the Durham Region Association of REALTORS reported 769 residential sales in the Durham Region, up 14.5% from the 671 sales of March, but down 19% from April 2024, when 948 sales were reported. Year-to-date we are down 19 % in sales from the same period in 2024, with 2,495 sales so far through the MLS system.

The average selling price in the Durham Region for the month of April was a very nominal gain in value month-over-month at $913,500, representing an increase of just $2,104 from the March 2025 average of $911,396. While this is considerably lower -- by $30,340 or 3%, -- than last year’s April average of $943,840, it at least still continues the steady, albeit much slower, upward trend for 2025 that started in January.

The amount of new listing inventory coming onto the market in April was 2,135 units, increasing by 198 units, or 10%, from March’s 1,937. Compared to April 2024, when 1,840 units entered the market, we are up an impressive 295 units, or 16%. Year-to-date, we are up 22% in the number of listings coming onto the market compared to 2024, with 6,619 listings taken to date.

The average days on market for April rose to 19 days, up from the 17 day average posted for March. The average Sale Price to List Price Ratio (SP/LP) for all properties sold in April was a strong 101%.

The current Months of Inventory factor came in at 3.2 – a number commensurate with a market saturated with inventory. The Sales to New Listing Ratio (SNLR) for the month of April was an unsurprising 36% -- a clear indication that buyers are in control of the market. Typically, ratios between 40% and 60% reflect market balance, with anything below that range suggesting a market that favours buyers and anything above it, a market that benefits sellers.

The Durham Region saw a dollar volume in sales of $702,481,131 in April -- making the year-to-date total 21% lower than the previous year-to-date. Breaking that down into the top 3 spots: Oshawa placed first at $162 million, down 23% year-to-date, with an average sale price 3% lower year-to-date; Whitby placed second, with a volume in excess of $139 million, making Whitby’s total 26% lower year-to-date, and its average sale price down 5% yearto-date; Pickering rounded out the top 3 communities in Durham by posting $118 million, with a year–over-year decrease of 13% and an average sale price 4% lower year-to-date. Source: CLAR

FOCH: A BRUTAL APRIL LEAVES BUYERS WATCHING FROM THE SIDELINES IN THE GTA (DANIEL FOCH, REALESTATEMAGAZINE.CA)

The Greater Toronto Area housing market just logged one of its ugliest Aprils in recent memory. Inventory is exploding. Sales are evaporating. Prices are falling across nearly every category. And buyers? They’re nowhere to be found. There’s no panic in the streets, just a silent standoff. Sellers are flooding the market with listings, while buyers sit on their hands, watching values slide. It’s not a crash, but it’s close enough to leave bruises. And it’s not a typical correction, either. What we’re witnessing is something slower, quieter, and far more stubborn: a full-scale collapse in conviction.

While some sellers are still clinging to 2022 valuations, buyers are recalibrating. Many are starting to believe that the longer they wait, the better the deal. That belief becomes a self-fulfilling prophecy. It delays transactions and forces sellers to concede further on price. This isn’t just anecdotal. It aligns with broader consumer trends. Modest wage growth and high household debt levels are creating a structurally cautious buyer pool. Even affordability improvements through lower prices are failing to spark demand. That suggests the core issue is no longer affordability alone, but conviction.

Where this is headed…

Price pressure will likely intensify. With listings still climbing and sales still declining, pricing pressure is inevitable. Unless demand stages a meaningful comeback in May or June, sellers, particularly in the condo segment, will be forced to chase the market down. Buyers know this. Their expectations are now shaping price direction as much as macro forces.

The market is functioning, but without momentum. Deals are still happening, and hence the market isn’t frozen. But it’s one without direction. The fundamentals have become disconnected. In this kind of market, liquidity exists, but only for sellers willing to discount, and only for buyers confident enough to act. That’s not a healthy balance. That’s fragility.

The next move belongs to the Bank of Canada. The Bank of Canada’s next policy moves will be critical. If it signals rate cuts in the coming months, that could thaw demand by late summer or fall. But if it holds firm, the current limbo could stretch into Q3 and beyond. Until then, expect: longer days on market, more aggressive price reductions and most critically, buyers to continue to wait.

Final thought: The market isn’t crashing—it’s stalling. There’s no panic in the numbers. But there’s no pulse either. What April has made painfully clear is this: the GTA housing market isn’t functioning on fundamentals anymore. It’s functioning on fear of overpaying, catching the knife, and making the wrong move in a directionless environment. Until something changes, the only thing moving quickly in this market is time.

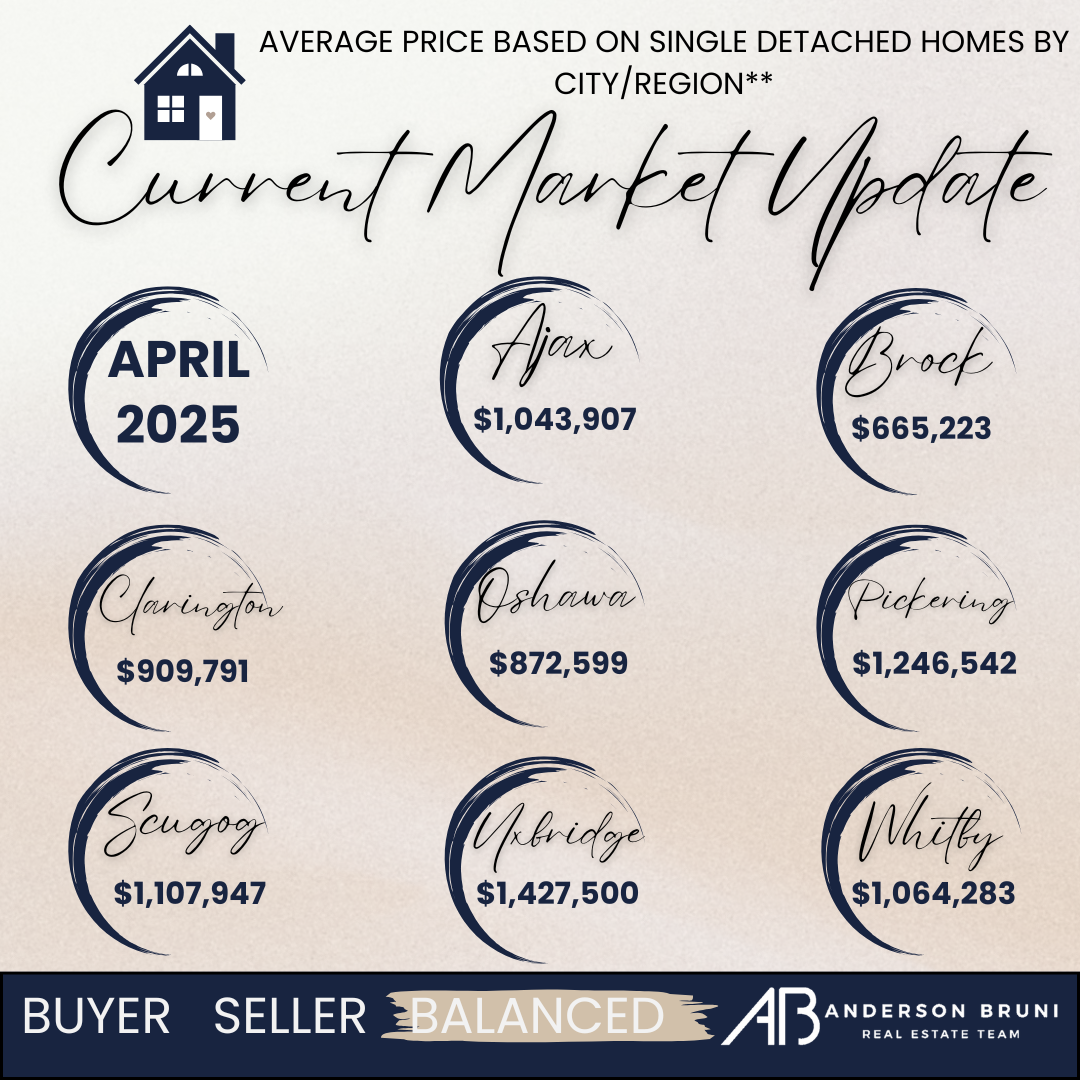

CURRENT MARKET UPDATE:

As always, we are sincerely grateful for the opportunity to serve your real estate needs, and those of your family and friends, neighbours and co-workers. It is a constant thrill to receive personal recommendations from our clients, and we have been so fortunate to be able to build our business on our name and reputation – and it’s all thanks to you!

Post a comment