A SHIFT FOR SPRING!

In the real estate world, we have seen a radical shift in the market since the third week in February and the repercussions are showing up on our stats for the month of March, reported here. Inflation, the Russian war on the Ukraine, the threat of looming interest rate hikes and just recently, the release of the new Federal budget, have all contributed to a massive increase in listing inventory since the beginning of March, thus changing the landscape for buyers quite significantly. It’s great news for buyers, especially our resident buyers, who now have a selection of homes to choose from locally, and no longer have to extend their search so far and wide from the Durham Region. For sellers, it means strategy and negotiation have never been more essential, and analyzing the competitive micro-market is of paramount importance.

Overall, we believe that this could be a temporary blip due to an unforeseen amount of circumstances converging at the same time to considerably change the dynamic of the marketplace. Our local market is moving towards surplus, with a wider variety of homes and price ranges to choose from. As a result, we are seeing fewer and fewer homes selling in multiple offer situations, and many not selling at all, as the market correction elbows out the seller with unrealistic expectations. Pricing a home appropriately is a key factor now in the success of a sale, as bank appraisals will no doubt begin to lean towards much more conservative numbers. The return to a more normal market may also herald in the return of conditional offers once again. Only time will tell.

We have definitely experienced a sudden turnabout in the market, perhaps the most pronounced in the last 5 years since the second quarter of 2017. But like all markets – whether financial or real estate – we are always in a state of flux, open to a myriad of economic factors that can affect and shift value within the macro market at large just as easily as the micro-market of your neighbourhood. As conditions continue to evolve, we are committed to providing you with the most current information available and proving our worth to you as your real estate advisors for life. Thank you for continuing to recommend us to your friends and family, co-workers and neighbours.

It’s Open House season once again! If you’re looking to get out and visit some fabulous homes, visit our website at remaxjazz.com for a fresh array posted every week, and please tell your friends about it. Our corporate Facebook page – RE/MAX Jazz Inc., Brokerage – and Instagram account - @remaxjazzinc --also feature newsworthy announcements and daily posts about the real estate market and industry. Please become part of our community by “liking” and following us!

In March, the Durham Region Association of REALTORS reported 1,390 residential sales in the Durham Region, up 23.5% from February 2022, but down 33% from March 2021, when 2,076 sales were reported. Year-to-date we are down 24% in sales from the same period in 2021.

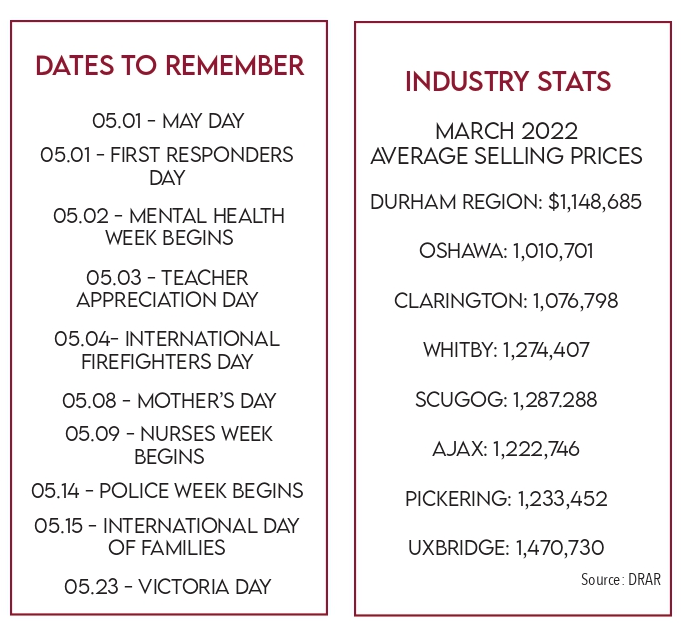

The average selling price in the Durham Region for the month of March was another incredible number overall, at $1,148,685; however, this represents a decrease of 6.5% from the all time high of February 2022. This new average represents an increase of $247,411 -- or 27.5% -- over the previous March average of $901,274! This marks the 3rd consecutive month that the average price in Durham Region exceeded the $1 million mark for 2022!

The amount of new listing inventory coming onto the market in March 2022 was 2,473 units, up over 53% from February 2022 but down 12% from the same record setting period the year before, which saw a whopping 2,837 new listings enter the market. Year-to-date we are down 14% in the number of listings coming onto the market compared to 2021. These numbers are a little misleading as they do not account for the large amount of terminations and suspensions of properties that we are currently witnessing.

The average days on market for March 2022 remained at 7 days. The average Sale Price to List Price Ratio (SP/LP) for all properties sold in March was an impressive 123%.

The current Months of Inventory factor rose to 0.7 -- still a low number but not nearly as low as we have seen over the past 2 years. The Sales to New Listing Ratio (SNLR) for the month of March was a very balanced 56.2%. This marks the first time we have seen a number that reflects true market stability in a very long time. Typically, ratios between 40% and 60% reflect market balance, with anything below that range suggesting a market that favours buyers and anything above it, a market that benefits sellers.

The Durham Region saw a dollar volume in sales of $1,596,672,449 in March -- making the year to date number perfectly even with the same time period as 2021. Oshawa once again led the way, with a volume in excess of $412 million, making Oshawa’s total 5% higher than March of 2021, and its average sale price 36% higher than March 2021. Whitby placed an honourable second at $321 million, with a 1% increase over the previous year, and an average sale price increase of 35% over March 2021. Clarington posted $272 million, with a year–over-year decrease of -5% but an average sale price increase of 33% over March 2021.

Source: DRAR

As always, we have included below a snapshot of performance of the overall market in the Durham Region for the month.

For a more specific look at your community, your neighbourhood and your housing style, just call us! We are always available to update you personally on current statistics and inventory, and how they are affecting your home’s value.

AVERAGE PRICE BREAKDOWNS FOR MARCH:

The average detached dwelling sold for $1,254,499 at 122% of list price in 7 days. 953 units sold. The average semi-detached dwelling sold for $977,258 at 126% of list price in 6 days. 102 units sold.

The average link dwelling sold for $1,043,635 at 124% of list price in 5 days. 17 units sold.

The average freehold townhouse sold for $1,008,487 at 124% of list price in 6 days. 171 units sold.

The average condominium apartment sold for $697,840 at 120% of list price in 8 days. 65 units sold.

The average condominium townhouse sold for $803,688 at 123% of list price in 7 days. 82 units were sold.

Source: DRAR

Post a comment