NOVEMBER 2022 MARKET WATCH

Friday Nov 11th, 2022

THE MARKET IS STILL STRONG IN DURHAM REGION… FOR THE MEANTIME!

Many of our average selling price categories look very similar to those of last month; with some even rising, like that of the condo apartment. While our market continues to adjust to higher borrowing costs and squeezes out a significant number of potential players from our buyer pool, the real estate market in our area continues to weather the storm quite well.

How is that possible, you may ask? Well, the September new listing inventory reported by the Toronto Regional Real Estate Board (TRREB) was the lowest number of listings taken since 2002. This is even more disconcerting when one factors in the housing starts enjoyed by the GTA over the last 20 years; certainly we have seen an impressive increase of new home communities in the last two decades! So the low inventory numbers we are experiencing are no doubt contributing quite significantly to the stabilization of resale values we are seeing. As more inventory enters the market, that false stability could easily be revealed for what it is: an artificial and misleading market on the brink of a sizable correction. Truly, the only thing propping up our current local market is the lack of seller participation. Multiple offer scenarios are still occurring with remarkable frequency and the buyer appetite for both home flips and conversions has yet to be quenched, as is evidenced by many recent sales of property that required great overhaul, yet garnered offers numbering into the twenties.

The overarching truth of our undeniably attractive location coupled with the sheer lack of available housing in Canada paints the picture for the long term success of our housing market. But be forewarned: short term pain is coming. Interest rates show no sign of leveling off.

For your trust and your business, and for recommending us to your friends and family: THANK YOU!

The Month of September in Review

In September, the Durham Region Association of REALTORS reported 662 residential sales in the Durham Region, down a whopping 34% from the 1,006 sales of September 2021, and almost 18% from August 2022, when 806 sales were reported. Year-to-date, our sales volume is down 30% compared to 2021, with 8,312 homes selling so far this year.

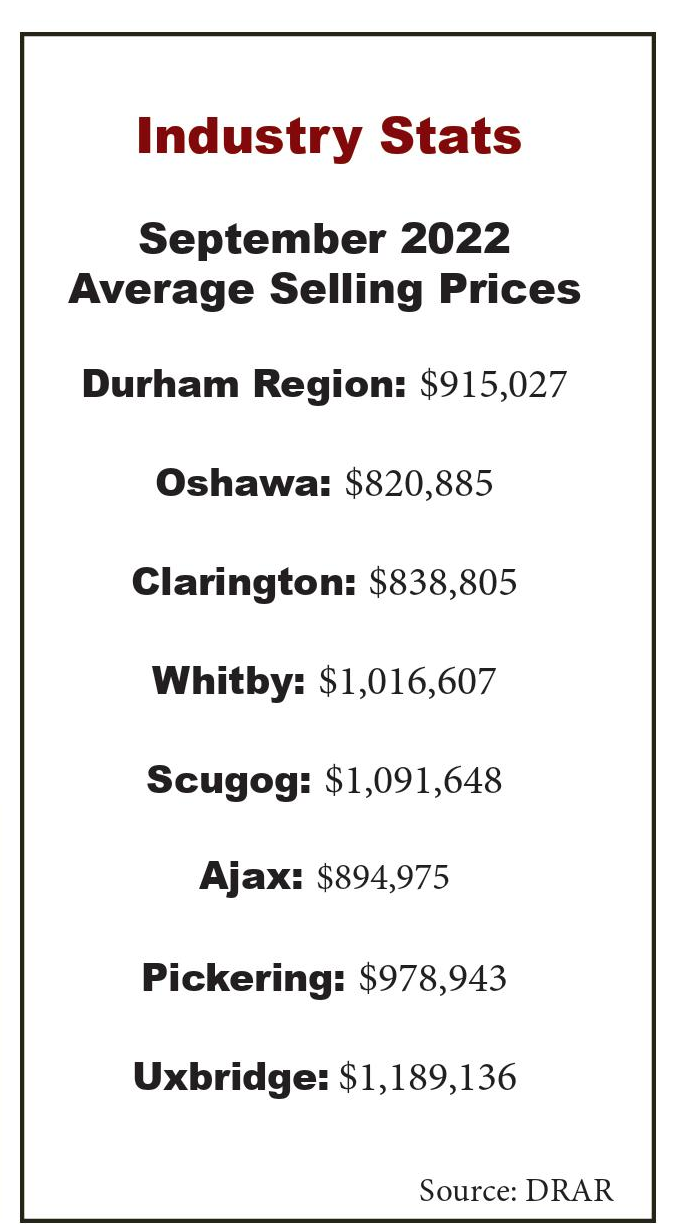

The average selling price in the Durham Region for the month of September was $915,027, down just .5% from August when we saw an average of $920,269, and down 5.5% from the September 2021 average of $968,136. September 2022 represents the fifth consecutive month where the average sale price has fallen below the one million dollar mark. While we experienced a very slight drop between August and September – which is great news -- the real number to look at is the 5.5% drop year over year. In the scheme of things, Durham Region is certainly holding its own in value, especially when compared to other Ontario markets that are going through substantial market value losses right now. These monthly averages for Durham Region still represent very impressive numbers when viewed in the context of our annual historical averages over the past 5 years: in 2017, the average selling price in the Durham Region was $628,005. Even in September of 2020, the average home was selling for just $734,038, so comparatively; we are still enjoying tremendous gains. Year to-date, the average sale price of all residential real estate sold in the Durham Region is $1,050,356 -- up $142,235, or almost 16% -- from the previous year-to- date numbers.

The amount of new listing inventory coming onto the market in September was 1,194 units, down 6.5% from the 1,275 new listings in the previous month and down 9% from the same period the year before, which saw 1,314 new listings enter the market. Year-to-date we are only slightly behind in listings taken – just 78 units less than the 2021 numbers. Year-to date, we have seen 15,479 properties enter the market through the MLS system in Durham Region.

As always, we have included below a snapshot of performance of the overall market in Durham Region for the month. For a more specific look at your community, your neighbourhood and your housing style, just call us. We are always available to update you personally on current statistics and inventory, and how they are affecting your home’s value.

HERE’S THE AVERAGE PRICE BREAKDOWN FOR SEPTEMBER

The average detached dwelling sold for $1,002, 111 at 99% of list price in 18 days. 457 units sold.

The average semi-detached dwelling sold for $761,625 at 102% of list price in 15 days. 53 units sold.

The average link dwelling sold for $776,778 at 99% of list price in 14 days. 9 units sold.

The average freehold townhouse sold for $805,082 at 101% of list price in 15 days. 65 units sold.

The average condominium apartment sold for $573,515 at 97% of list price in 27 days. 38 units sold.

The average condominium townhouse sold for $657,547 at 99% of list price in 19 days. 40 units were sold.

SHOULD I BUY A HOUSE NOW OR WAIT UNTIL 2023?

If trying to time the housing market has you feeling overwhelmed, you’re not the only one. It never seems to be a good time to buy a house – markets seem to be red hot or freezing cold. But you’re going to need somewhere to live, regardless of what’s going on in the economy. And builders are still building and working hard to find ways to get you into their homes, despite rapidly climbing mortgage rates that force buyers to either pay more each month for the house of their dreams or pay less for a house that feels like a compromise. The solution to your problem is information – the better informed you are the better you’ll feel about buying a home in volatile economic times. Here’s what to consider when buying in a difficult market:

You decide when it’s the right time to buy a house.Here’s a secret that most Wall Street economists don’t want you to know – no one can predict how markets will change with 100 percent accuracy. That makes timing the market impossible – buy what you can afford when you’re ready to buy. Simple. There’s no mathematical formula to determine whether now is the right time to make a commitment – so don’t feel like you have to make a decision just because of FOMO. Rather than focusing on what your friends or the latest headlines are saying, assess your personal situation to decide whether it’s the right time to buy.

FOMO vs FOBATT : What on earth is FOMO? It means ‘fear of missing out’ – and in the past, that fear dominated the housing market. Buyers used to rush to purchase anything that hit the market out of fear that prices were accelerating. Today it’s a little different, and buyers are suffering from FOBATT – fear of buying at the top. FOBATT is impeding home purchases as buyers are spending more time waiting for the market to change than they are shopping for homes. The hope is that waiting months or years will mean scoring a better deal on a house, even though that’s not a guarantee. As mentioned before, there’s no real way to predict the future with 100 percent accuracy. Which means no matter how anxious you are about the price of buying – it can always get more expensive. Fear of buying at the top can quickly turn into missing your window to enter the market entirely. Remember – you’re not playing the stock market, you’re investing in a home that is meant to serve you for a lifetime.

Post a comment