ABteam April 2025 Blog Post

Monday Apr 14th, 2025

WELCOME TO THE ABTEAM APRIL BLOG

UNCERTAINTY IN THE CURRENT HOUSING MARKET COULD SPELL OPPORTUNITY FOR MANY…

Right now we are experiencing conditions not unlike other volatile periods in history, where the value of all of our homes and properties are potentially a more fluid metric than usual, and many would-be buyers may choose to play the wait-and-see game. And that would be a shame; perhaps, even a mistake.

Yes, the foreseeable economic future for Canada -- because of the trade war that has just begun – is, as yet, unclear. But what we do know is this: inflation has returned to target, interest rates have dropped notably and our economy going into this was on the right track.

A perceived lack of economic stability always shakes faith in the housing market. Always. But please remember that the housing market underpins the entire economy, so if anything, the Bank of Canada and the federal and provincial governments will work together to reduce rates and implement incentives to make home buying accessible and keep things moving.

We have absolutely no information on the breadth or length of this structural change introduced by the US. We have no idea when the consequences will actually be felt. In short, we have no data.

But in the meantime, people still get married, change jobs, move away, start families, separate, retire and pass away. Life still goes on and everyone still needs a place to call home.

Navigating a market like this takes infinite finesse teamed with a tactical approach in order to protect those who want to participate. Let us know if there is someone in your life that would benefit from a meeting with us before they make a decision. Being the leaders of Durham Region’s real estate marketplace for the past sixteen years simply means we know how to serve and safeguard people. That’s why we produce this vital monthly market update; we want our clients educated on their holding’s performance and growth, as we truly believe that your home is your most valuable asset. It is the foundation of your financial portfolio and the one

thing that will inform almost every lifestyle decision you will ever make. It is the only investment that you can leverage fully without taxation, so that you can fund your kids’ tuitions, acquire that vacation property or invest in the triplex down the street. Canadian real estate has proven to be exceptional as an investment vehicle: safe, with outstanding performance long term, and even the current events taking place on the geo-political stage won’t change that.

AWAITING FURTHER RATE CUTS BEFORE REFINANCING YOUR MORTGAGE? BETTER TO ACT NOW! Robert McLister- Financial Post: While surfing tariff chaos for lower mortgage rates might seem attractive, avoid stalling and pull the trigger now.

Rates like 3.99 per cent have mortgagors increasingly jumping at refinancing opportunities to trim their payments or tap into home equity. All the recent rate cut speculation is only turbocharging this enthusiasm.

In fact, refinances seem to comprise a fast growing share of mortgages. While Canada doesn’t have timely industry-wide mortgage data like the U.S., refinances in March rose eight percentage points year-over-year at Canada’s biggest mortgage originator, the Dominion Lending Centre Group. Purchase volumes tumbled by a similar amount.

Many believe mortgage rates will dip further as the trade spat throws Canada into an economic funk. Consequently, I’m hearing from more and more people who think that pushing out the closing date on their refi might yield better rewards.

Well, after Wednesday’s tariff pause, all bets are off. The U.S. President dialed tariffs down to a manageable 10 per cent for most nations to allow trade negotiations for 90 days. His spokespeople hinted that Trump’s tariff brinkmanship was all just a gambit to get countries to the negotiating table. That raised speculation that high tariffs won’t be long-lasting and that substantial rate drops are less likely.

Whatever the case, while surfing the tariff chaos for lower mortgage rates might seem attractive to some, here are six reasons to avoid stalling and pull the trigger now (assuming you need to refinance):

- Personal time constraints: Some folks have urgent needs to tap their home equity. Others could save money (after penalties and closing costs) by moving to a lower rate now. For these borrowers, deferring closing date may not even be practical.

- Timing is tricky: Even central bankers at the Fed and Bank of Canada can’t accurately forecast interest rates beyond their next coffee break. Wildcard headlines — like Trump’s tariff breather on Wednesday — can come out of nowhere. How is a layperson supposed to clock the exact second rates pivot, nailing the refinance sweet spot?

- Penalty risk: For homeowners locked into fixed mortgages (especially at the big banks) — when discounted rates slide, posted rates usually follow suit. And as I highlighted last week, falling posted rates can inflate your prepayment charges — doubling, tripling or even quadrupling your penalty. Depending on the lender, penalties can easily offset the benefit of waiting to refinance.

- Float-down rules: Certain lenders play nice, letting you repeatedly reset your interest rate downward before the ink dries. Others have what’s called “no float down” rules. That means they don’t let you drop your rate, even if rates go down. Or they limit you to one float down. Borrowers detest being told that they can’t lower their rate when new customers are getting much better deals. However, most lenders with “no float down” rules — mainly mortgage finance companies, a.k.a. “MFCs” — will float a customer down all day long if they threaten to cancel their application, especially if their file with the lender is complete and waiting to close.

- Long-term rate holds: Many lenders don’t allow long-term rate holds (e.g., 120 days) on a refinance application. That’s a factor worth noting if you choose one of these lenders. Most banks allow at least 90- to 120-day rate holds on refinances, but their prepayment options and penalty policies might be worse than an MFC. The nation’s biggest mortgage lender (RBC), for example, will hold a refinance rate for 120 days. That gives you lots of wiggle room. On the other hand, its fixed-rate penalty policy is unfavourable, and it only allows 10 per cent lump-sum prepayments annually on the anniversary date (annoyingly restrictive).

- Appraisal risk: For anyone counting on squeezing every dollar out of their home equity, declining home values are about as funny as a password data breach. When your home price falls, your loan-to-value (LTV) ratio rises. Once your LTV exceeds 80 per cent, you can no longer refinance at reasonable terms. Big banks like Scotiabank, TD or BMO let you do appraisals up front and then wait several weeks to close — generally without needing to update the appraisals before closing. Note, however, that if home prices were to theoretically tank nationwide, banks reserve the right to require updated appraisals, despite their standard policy. For refinancers who need every ounce of equity, the risk of home values falling is one more reason to refi ASAP versus in 90 to 120 days.

INTRODUCING THE NEW MORTGAGE QUALIFICATION TOOL ON REALTOR.CA - SIMPLY YOUR HOME BUYING JOURNEY:

Buying a home is one of the most exciting milestones in your life—but let’s be honest, it can also feel overwhelming. Between browsing listings, crunching numbers, and figuring out your budget, the process can leave even the most prepared home buyers with questions.

That’s why REALTOR.ca is thrilled to announce you can now get qualified for a mortgage without leaving Canada’s No. 1 real estate platform, empowering you to navigate the home buying process faster and easier!

Whether you’re just starting to explore your options, or you’re ready to take the plunge, this mortgage tool is here to help you understand exactly where you stand financially—so you can focus on finding the home of your dreams.

Why This Mortgage Tool is a Game-Changer

At REALTOR.ca, we’re all about empowering you to make informed decisions. The new mortgage qualification tool on REALTOR.ca is your personal guide to understanding your financial readiness. Here’s what makes it so valuable:

- Quick and free—Get a full mortgage qualification, with no cost to you.

- Clarity and confidence—Know exactly how much home you can afford before you start house hunting, so you can focus on properties that fit your budget.

- Effortless access —This tool is available on REALTOR.ca so you can use it while browsing listings without needing to visit another platform.

How It Works: Simple, Fast, and Stress-Free

The mortgage qualification tool is designed to be intuitive and user-friendly. Here’s a step-by-step look at how it works:

- Choose your mortgage type. Whether you’re buying, refinancing, or renewing, select the option that fits your needs.

- Pick a lender or broker. Decide whether you’d like to work directly with a lender or a brokerage to help you through the process.

- Create an account. Sign up to save your progress and allow lenders to contact you with personalized offers.

- Apply solo or with a partner. Whether you’re applying on your own or with a co-applicant, the tool makes it easy to include all the necessary details.

- Provide your financial details. Fill in information about your income, employment, and expenses to build a complete picture of your financial situation.

- Upload supporting documents. Securely upload documents like pay stubs or tax returns to strengthen your application.

- Verify your assets. Connect to your bank to confirm your assets and liabilities, ensuring the most accurate results.

- Run a credit check. The tool will perform a soft credit check (this won’t affect your score) to verify your financial profile.

- View your mortgage offers. Once your details are confirmed, you’ll receive a list of mortgage products tailored to your financial situation.

Tips to Boost Your Mortgage Qualification Odds

While the tool makes it easy to see where you stand, a little preparation can go a long way in improving your chances of qualifying for a mortgage. Here are some practical steps to get started:

- Check your credit score. Your credit score is one of the most important factors lenders consider. Most require a minimum score, so it’s a good idea to check where you stand before applying. (Don’t worry—checking your own score won’t have a negative impact on it.)

- Review your credit report. You’re entitled to a free credit report every 12 months from each of the major credit bureaus. Take the time to review yours for errors, like incorrect payment statuses or outdated account information. If you spot any mistakes, file a dispute to have them corrected.

- Get a sense of your budget before you start hunting for a home. It’s important to know how much you can afford. Use REALTOR.ca’s Affordability Calculator to estimate your budget, and don’t forget to factor in additional costs like property taxes, insurance, and closing fees.

Ready to Take the Next Step?

Buying a home doesn’t have to feel overwhelming. With the new mortgage qualification tool on REALTOR.ca, you can approach the process with confidence and clarity. Whether you’re just starting to explore or you’re ready to make an offer, this tool is here to help you achieve your home buying goals.

Try it today and take the first step toward finding your dream home!

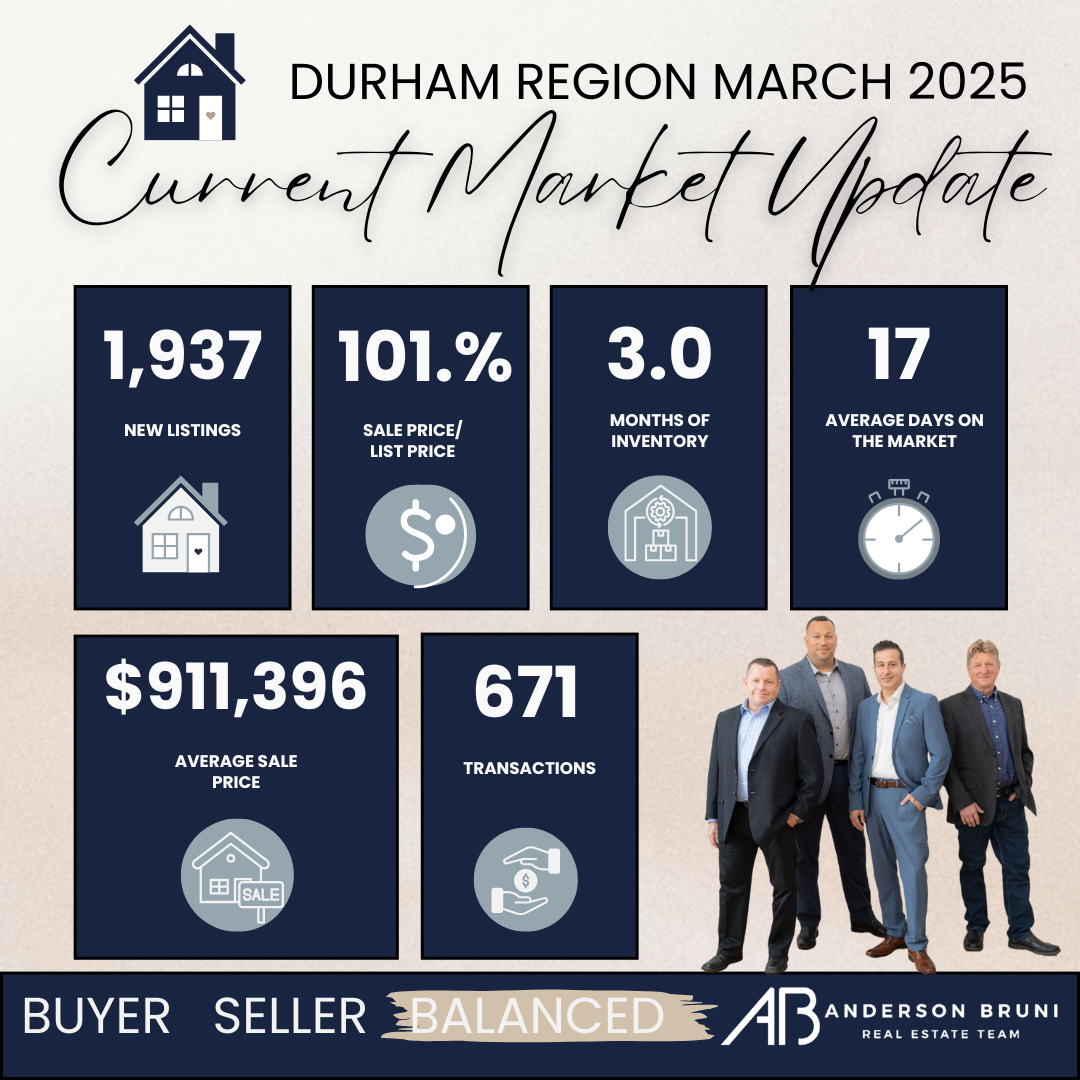

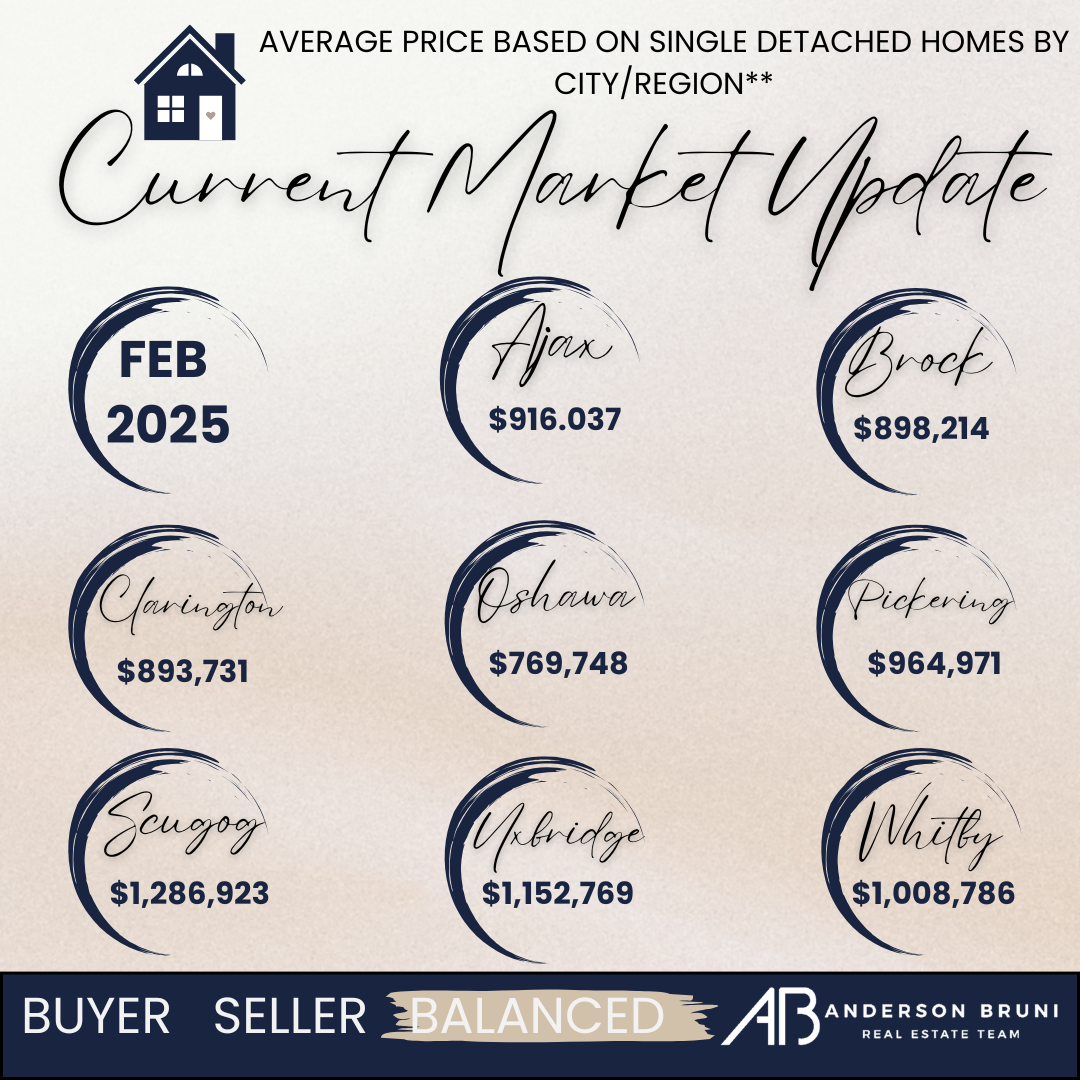

CURRENT MARKET UPDATE:

DURHAM REGION SP-EGG-TACULAR EASTER EVENTS:

Optimist Club of Oshawa Easter Egg Hunt

475 Salisbury Street, Oshawa, ON L1J 6L9, Canada

📅 Saturday, April 19, 2025

💵 CA$6.66

Kids' Safety Village Easter Eggstravaganza

1129 Athol Street, Whitby, ON, Canada

📅 Saturday, April 18, 2025 to Sunday, April 19, 2025

💵 CA$5.00 (per child)

Easter on the Farm at Maple Grove Orchards

3700 Maple Grove Road, Bowmanville, Clarington, ON, Canada

📅 Saturday, April 19, 2025, to Sunday, April 20, 2025

💵 CA$10.00 (per person)

Lunch with The Easter Bunny!

2372 Durham Regional Highway 2, Bowmanville, ON L1C 4Z3, Canada

📅 Sunday, April 13, 2025

💵 Free Admission

Easter at Pingle's Farm

1805 Taunton Rd, Hampton, ON, Canada

📅 Saturday, April 12, 2025, to Sunday, April 20, 2025

💵 CA$16.00 (plus HST & fees for pre-sale tickets)

Durham Easter & Spring Market

111 Hunt Street, Ajax, ON L1S 1P5, Canada

📅 Saturday, April 19, 2025

💵 Free

Vandermeer Nursery Easter Egg Hunt & Bunny Bowl

588 Lake Ridge Road South, Ajax, ON L1Z 1X3, Canada

📅 Friday, April 18, 2025, to Sunday, April 20, 2025

💵 CA$13.50 (plus taxes)

Pickering Easter Parade

Bay Ridges Kinsmen Park, Sandy Beach Road, Pickering, ON, Canada

📅 Saturday, April 19, 2025

💵 Free

Easter Egg-stravaganza - Sideroads of Scugog

975 Regional Rd 21, Port Perry, ON L9L 1B5, Canada

📅 Friday, April 18, 2025 to Sunday, April 20, 2025

💵 CA$15.00 (per person, ages 2 to 92)

Port Perry Easter Eggstravaganza

14480 Old Simcoe Road, Port Perry, ON L9L 1C5, Canada

📅 Saturday, April 19, 2025

💵 Free

36th Annual Port Perry Easter Egg Hunt & Bonnet Contest

175 Water Street, Port Perry, ON, Canada

📅 Sunday, April 20, 2025

💵 Free

Skate With The Easter Bunny

291 Brock Street West, Uxbridge, ON L9P 1G1, Canada

📅 Saturday, April 19, 2025

💵 Free

Uxbridge BIA Easter Eggstravaganza

Brock Street West & Toronto Street South, Uxbridge, ON, Canada

📅 Saturday, April 19, 2025

💵 Free

OTHER THINGS TO DO IN DURHAM REGION DURING EASTER:

Durham Region in Ontario, which includes cities like Oshawa, Whitby, Ajax, and Pickering, offers plenty of activities during the Easter break. Here’s a list of things to do:

1. Easter-Themed Events

-

Easter Egg Hunts:

-

Many parks and community centers organize Easter egg hunts. Look for events at:

-

Heber Down Conservation Area in Whitby

-

Rotary Park in Ajax

-

Pickering Museum Village in Pickering

-

-

Farms like Pingle’s Farm Market in Hampton often host Easter-themed activities, including egg hunts and crafts.

-

-

Easter Brunches:

-

Many restaurants and hotels offer special Easter brunches. Check out:

-

Deer Creek Golf & Banquet Facility in Ajax

-

Ajax Convention Centre

-

Bistro '67 in Whitby

-

-

2. Outdoor Activities

-

Hiking and Nature Walks:

-

Explore the Greenwood Conservation Area in Ajax for trails and scenic views.

-

Visit Darlington Provincial Park near Oshawa for a peaceful walk by Lake Ontario.

-

Hike the trails at Stephen’s Gulch Conservation Area in Clarington.

-

-

Parks and Beaches:

-

Enjoy family time at Lakeview Park in Oshawa or Whitby Waterfront Park.

-

Visit Frenchman’s Bay in Pickering for a waterfront walk and nearby cafes.

-

3. Family-Friendly Activities

-

Museums and Heritage Sites:

-

Visit the Canadian Automotive Museum in Oshawa to explore Canada’s automotive history.

-

Check out the Pickering Museum Village, which often hosts special events during Easter.

-

The Oshawa Museum offers a glimpse into the region’s history and heritage.

-

-

Indoor Fun:

-

Head to Airzone Trampoline Park in Oshawa or Sky Zone in Whitby for family-friendly fun.

-

Take kids to Playdium Whitby for arcade games, bowling, and more.

-

4. Shopping and Markets

-

Pickering Town Centre and Oshawa Centre are great for shopping, dining, and Easter-themed events.

-

Farmers’ Markets:

-

Visit the Whitby Farmers’ Market or Clarington Farmers’ Market for fresh produce and crafts.

-

5. Cultural and Arts Events

-

Check out live performances at the Regent Theatre in Oshawa.

-

Attend workshops or exhibits at the Station Gallery in Whitby.

-

Look for family-friendly movie screenings or events at local libraries.

6. Seasonal Attractions

-

Maple Syrup Festivals:

-

Visit Purple Woods Conservation Area in Oshawa to enjoy the tail end of maple syrup season, with hikes and syrup tastings.

-

-

Spring Flower Blooms:

-

Explore gardens like the Oshawa Valley Botanical Gardens for early spring blooms.

-

DATES TO REMEMBER:

APRIL 18TH - GOOD FRIDAY

APRIL 20TH - EASTER SUNDAY

APRIL 21ST - EASTER MONDAY

APRIL 22ND - EARTH DAY

APRIL 23RD - ADMINISTRATOR'S PROFESSIONAL DAY

APRIL 30TH - INTERNATIONAL JAZZ DAY

As always, we are sincerely grateful for the opportunity to serve your real estate needs, and those of your family and friends, neighbours and co-workers. It is a constant thrill to receive personal recommendations from our clients, and we have been so fortunate to be able to build our business on our name and reputation – and it’s all thanks to you!

Post a comment